Why Cycling is Becoming the Cool New Sport Amongst Young People Cycling is no longer just that thing your grandpa…

Read More

Why Cycling is Becoming the Cool New Sport Amongst Young People Cycling is no longer just that thing your grandpa…

Read More

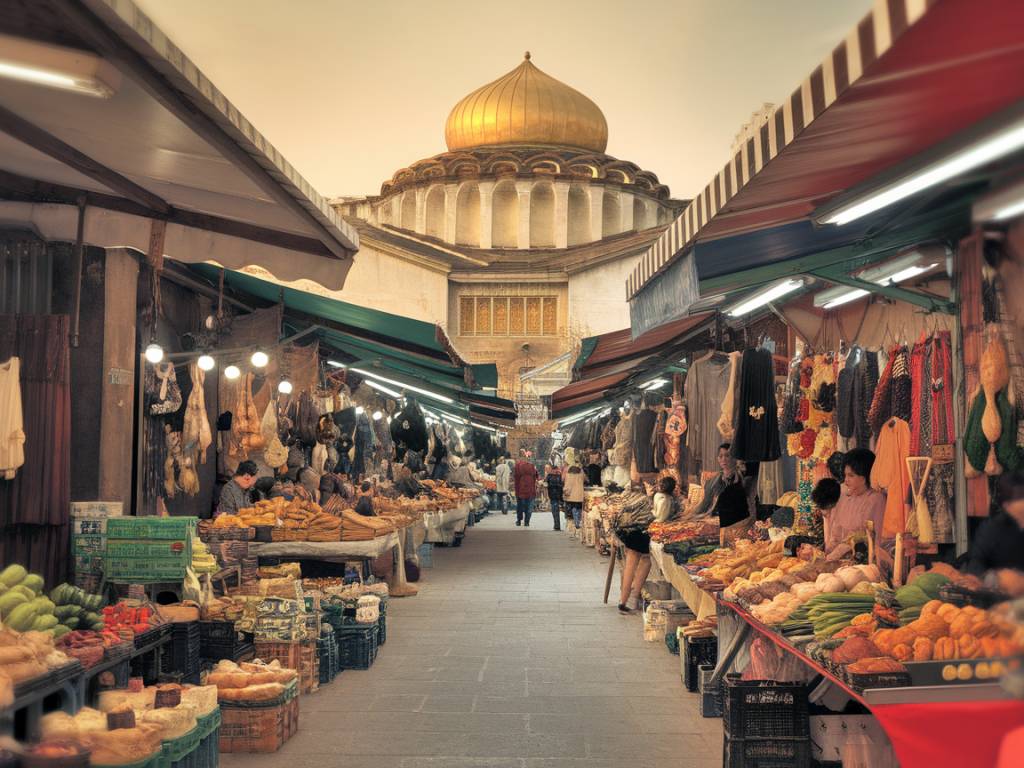

Why Experiential Travel Is the Ultimate Way to Explore the World Have you ever felt like your vacations lacked something?…

Read More

Why Hiking is the Ultimate Adventure for Young Travelers Traveling is like hitting a refresh button on life, and what…

Read More

The Phenomenon of Esports: A Real Sport or Just Gaming? What comes to mind when you hear the word «…

Read More

Skateboarding isn’t just a sport. It’s a lifestyle, an art form, and, for many, a way of existing in the…

Read More

Juggling School and Sports: Is It Even Possible? Let’s face it, being a young athlete is no walk in the…

Read More

Why Underrated Sports Deserve a Spotlight Not everyone dreams of being the next LeBron James or Serena Williams, and that’s…

Read More

Why Youth Mental Health Matters More Than Ever Let’s be real — being young today comes with a whole new…

Read More

Are you an active youth constantly juggling between school, sports, and social life? Or maybe you’re someone who just values…

Read More

Solo travel is no longer just for thrill-seeking adventurers or introspective poets with a backpack. It’s a movement, and it’s…

Read More